Get Your Medical FSA Money When Leaving a Company

You are entitled to all of your Medical FSA Money, even when you leave your company in the middle of the year.

- Your entire election is available to spend on January 1st, even though you won’t have fully funded it until the end of the year.

- The tax code (IRS Publication 969) has no language in it saying what should happen when you leave a company.

- I scoured the internets for an interpretation of the law and got a “mostly yes” mixed bag of answers (see below)

I recently had an interaction with American Fidelity about getting my Medical FSA money. I left my job and then 3 weeks later I submitted an expense that had occured while I was still working. American Fidelity denied the claim, saying that my account was closed out when I left. So I wrote to them:

My recent reimbursement request for my Health Care FSA was denied because I no longer work for my former employer. I stopped employment on February xx and health insurance from my employer will end on April xx. I submitted my reimbursement request on March 1st (American Fidelity Claim #xx) . Your own website notes “…if the employee has any additional eligible claims incurred prior to [their] date of termination, those claims may still be submitted for reimbursement up to the full elected amount…” I have submitted such a claim and expect to be reimbursed in accordance with the policy you put forth on your website. Please reach out to me with an approved FSA claim or a message indicating why you are continuing to decline this reimbursement request. Thank you very much.

Their response:

Thank you for contacting American Fidelity. We understand your concerns , and we apologize for the error with processing your claim.

Upon further review, we will be able to process the claim for the 1/24/2024 date of service. Please allow 3-5 business days for processing.

Yay!

I googled around for an interpretation. Here’s what I found

IRS Publication 969

“You must be able to receive the maximum amount of reimbursement (the amount you have elected to contribute for the year) at any time during the coverage period, regardless of the amount you have actually contributed.”

The “”use-it-or-lose-it” portion of Publication 969 is only concerned with possible carryover to the next year

——————-

Yes, I can get the FSA money

I need to present the claim before the “run-out period”

https://rmr.zendesk.com/hc/en-us/articles/360026564973-Using-FSA-Funds-After-Termination

https://www.askcip.com/resources/what-happens-to-fsa-funds-when-an-employee-terminates/

https://fsafeds.com/support/faq/all/1003

——————-

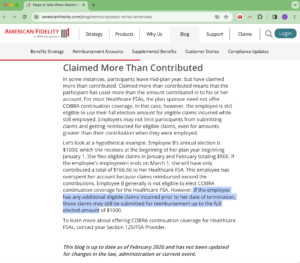

Strongly Implied yes, from AmericanFidelity themselves

https://americanfidelity.com/blog/reimburse/steps-hcfsa-terminate/

Employers may not limit participants from submitting claims and getting reimbursed for eligible claims, even for amounts greater than their contribution when they were employed.

——————-

Use it before my termination date / Use it with COBRA

https://livelyme.com/blog/what-happens-to-my-fsa-when-i-quit-my-job

https://employeebenefits.ri.gov/sites/g/files/xkgbur816/files/documents/fsa-faq.pdf

——————-

Maybe I can spend my FSA money

https://fsastore.com/articles/learn-fsa-cobra-coverage.html

https://wexbenefitskb.egain.cloud/system/templates/selfservice/dbinv/help/customer/locale/en-US/portal/308900000001012/content/PROD-2260/Using-flexible-spending-account-FSA-funds-after-terminating-employment-or-going-on-a-leave-of-absence

——————-

It’s a negotiation

https://www.washingtonpost.com/business/2023/03/02/work-advice-if-youre-laid-off-dont-leave-your-fsa-funds-behind/