Should I Pay Off Student Loans or Put The Money In the Stock Market?

Hypothetically, if you had three student loans totaling about $100,000 at different interest rates… say $3%, 5%, and 6%, would you push to pay them off or invest the “extra” money in the stock market?

My first thought was that the stock market generally pays 7% interest so I should pay down the 6% loan and put all the rest of the money into the stock market, but now I’m second-guessing myself. Thoughts?

Of course, first priority is to make a rainy day fund and pay into any matching 401(k) programs.

…

I found some answers for myself….

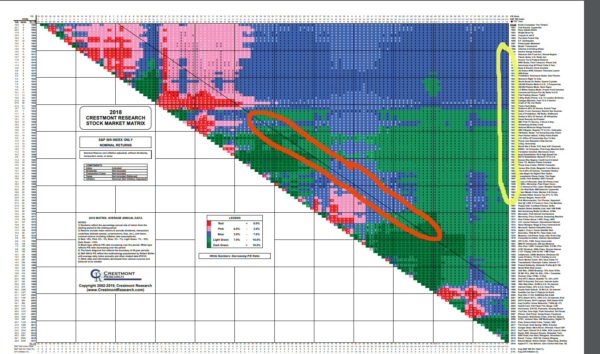

Look at this cool chart (via) (local copy). This chart shows how the S&P 500 index performed over the past hundred years. There is a “20 year” diagonal line, I highlighted it in red in the image to the right. Read the numbers on that line. For investments put in from 1930 until today, the S&P 500 has made pretty reliable 7% interest (as low as 4%, as high as 14%) per year. If you can wait 30+ years (highlighted in yellow in the image to the right), it’s a VERY reliable 7-9% interest rate, you can see that by looking at the far right side of the chart. Looking at the 10 year diagonal, the interest rates are more variable, -4% to 14%.

Look at this cool chart (via) (local copy). This chart shows how the S&P 500 index performed over the past hundred years. There is a “20 year” diagonal line, I highlighted it in red in the image to the right. Read the numbers on that line. For investments put in from 1930 until today, the S&P 500 has made pretty reliable 7% interest (as low as 4%, as high as 14%) per year. If you can wait 30+ years (highlighted in yellow in the image to the right), it’s a VERY reliable 7-9% interest rate, you can see that by looking at the far right side of the chart. Looking at the 10 year diagonal, the interest rates are more variable, -4% to 14%.

I’ve got about 20 years to retirement. With a 20 year window, the S&P 500 should always beat a 4% loan. Everything else is a crap-shoot. For example, with a 10 year window, $100,000 could balloon into $370,000 (that’s 14%, compounded yearly) woo hoo! That’s a nice nest-egg to retire on! Or, it could eviscerate $100,000 into $66,000 (4% loss, compounded yearly). [sad trombone] enough to get me into a chichi cardboard-box retirement community.

So what to do?

Since I’ve got 20 years left, invest in the stock market (claiming my 4 – 14%), making sure to diversify enough to match the S&P 500. But in 5 years, it’ll be time to switch to the safer (3 – 6%) investing of paying down student loans instead of continuing to invest in a riskier 10 year plan that pays (-4% – 14%).